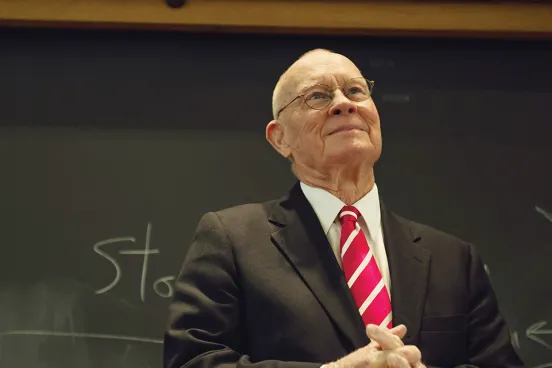

For George Smrtka, ’67, attending Michigan Law was a dream come true. “I applied to two other law schools, but Michigan was the top of the mountain for me. I never thought I could afford it, but the admissions counselor offered a scholarship for half of the tuition and the rest was covered through a loan. I also lived off-campus, washed dishes, and walked up a hill in the snow—both ways,” he laughs. “I’ve always had such an affection for the school because of the opportunity that was given to me—it was an incredible experience, and I got a great education.”

Smrtka, an estate lawyer, credits his interest in that area of the law to Alan Polasky, a former estates and trusts professor at Michigan Law who passed away in 1976. Professor Polasky would occasionally invite students and practitioners to his home to talk about the real “nuts and bolts” of estate planning, and those conversations piqued Smrtka’s interest in the field and set the foundation for his successful career.

“We learned that working with families was not a ‘one size fits all’ proposition. We also learned that you needed to be more of a social worker, therapist, friend, and confidant than a great trust drafter and tax mitigator,” says Smrtka. “Professor Polasky taught us that a client expects you to find a perfect solution, but that our real job was to advise them on which of their ‘myriad bad choices’ would be the best remedy! That lesson has been invaluable throughout my career. A large part of my work is to help people feel normal while going through a tough process.”

From his first meeting with the admissions counselor, Smrtka was told that he never had an obligation to give back to the school, but he has nonetheless given often throughout the years. “I received a letter telling me that if I gave, the school could continue to help others like they helped me. Boy, did that hit a nerve,” he remembers.

Recently, he decided to make a $50,000 bequest to Michigan Law from his IRA. “Looking at the horizon of assets, it’s one of the more tax-efficient ways to give,” Smrtka says, drawing from his 52 years of estate planning. “It just made a ton of sense to me that having the charitable inclination to start with, using an IRA is the best and most practical way to remember the school.

“I have so many great memories because somebody had the forethought to put that endowment together that allowed me to get half of my education paid for, and I’m glad I can give back and help future students,“ Smrtka says. “Ultimately, you learn that it’s your school for the time you’re there, and then it belongs to the next generation.” —CLP