Decarbonizing the aviation industry presents one of the greatest challenges in the global effort to reduce greenhouse gas emissions. The scale of the issue, which is something in the neighborhood of 2–3 percent of worldwide emissions, also presents an opportunity—any carbon-reducing innovation could cascade across the industry and result in a significant reduction.

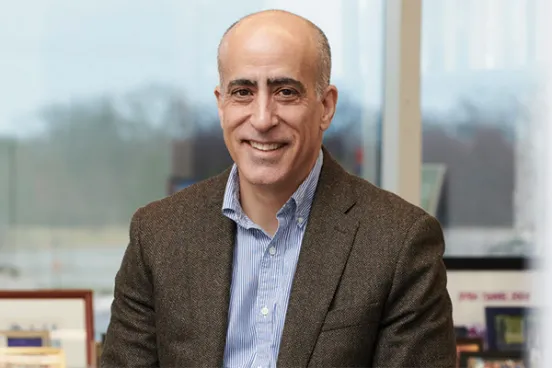

Alan Alexander, ’11, is acutely aware of this challenge. As a partner at Vinson & Elkins in Houston, Alexander works in the firm’s energy transactions group and supports clients in the development and financing of complex energy and infrastructure projects. He advises on contracts and other legal negotiations, including technology licensing, raw material procurement and construction contracts, and negotiating with capital providers.

His work on energy transition projects—including those focused on producing more-sustainable fuel for airplanes—involves collaborating with investors and clients in the energy sector to upgrade existing plants and invest in the research and development of renewable fuels and other low-carbon energy sources.

“One of the few ways to lower emissions in airplanes is through the decarbonizing of the fuel supply,” Alexander says. “Batteries are too heavy, and hydrogen-powered jet engines are in the research and development stage. So what we are left with is the need for a drop-in solution like sustainable aviation fuel.”

Capturing emissions for more sustainable fuel

Alexander recently advised Infinium, an energy producer that specializes in synthetic fuels, on a new project in West Texas, dubbed Project Roadrunner. The project recently received a $75 million investment from Breakthrough Energy Catalyst, a fund established by Bill Gates that invests in companies aligned with its goal of reaching carbon neutrality by 2050.

Project Roadrunner will produce sustainable aviation fuel (SAF) by upgrading an existing gas-to-liquids plant to run on waste carbon dioxide—captured from nearby processing operations that are currently emitting the CO2 into the atmosphere—and green hydrogen, which is hydrogen produced by renewable energies such as wind or solar power.

These fuels are nearly identical to conventional jet fuel and can generally use the same supply infrastructure and jet engines that are currently in use. And while these fuels are not carbon neutral, the use of waste CO2 represents a significant emissions reduction relative to conventional jet fuel.

“Basically, you take a CO2 molecule that would have otherwise been emitted and get another combustion cycle out of it,” Alexander says. “Extrapolated over the economy writ large, that can have a huge carbon reduction impact.”

Along with the investment from Breakthrough Energy Catalyst, getting Project Roadrunner off the ground involved an innovative offtake agreement with American Airlines, who has agreed to purchase SAF from the facility once it is active.

Capital-intensive projects

Offtake agreements like the one negotiated with American Airlines are important because most energy transition projects have a significant initial capital cost. Facilities can cost hundreds of millions or even billions of dollars to construct, with a years-long interim period before the plants begin to produce. This drives a need for investment from private equity; governments through direct investment or other incentives, like tax credits; and large companies with a strategic stake in green energy.

In Europe and Asia, many energy producers invest in greener technologies as the result of government mandates, such as policy related to the European Union’s goal of having net-zero greenhouse gas emissions by 2050. The US tends to take a more market-based approach—generally a combination of tax credits and other incentives to encourage private investment rather than direct regulation.

“Our role in Project Roadrunner was to create a structure that was amenable and attractive to equity investors, and tax credits are a big part of what made this project viable,” Alexander says. “We hope that over time these sorts of technologies can become cost competitive absent the tax credits and that these things become less capital intensive or cheaper and easier to do.”

He notes that the tax incentives built into the Inflation Reduction Act (IRA) of 2022, billed as the single largest investment in climate and energy in American history, have accelerated the growth of the low-carbon fuel sector.

“Coupled with an overall increase in sustainability investing and demand for a more sustainable, lower-carbon economy, we’re seeing more of these projects come to fruition,” says Alexander.

While Infinium may be one of the first companies to pursue this path to decarbonization, Alexander doesn’t think it will be the last. “There’s intense interest in the aviation industry to lower the carbon footprint of fuel.”

Alan Alexander, ’11One of the few ways to lower emissions in airplanes is through the decarbonizing of the fuel supply. Batteries are too heavy, and hydrogen-powered jet engines are in the research and development stage. So what we are left with is the need for a drop-in solution like sustainable aviation fuel.

Encouraging an emerging industry

The supply chain presents another challenge to the scale and affordability of sustainable fuels. Green hydrogen plants, for example, require electrolyzers that are not a particularly advanced technology, but limited demand has not supported the scale necessary for cost-efficient manufacturing. As a result, a relatively simple part is both expensive and in short supply. The IRA credits are already beginning to change that, Alexander says.

“These credits aren’t directly an incentive for the electrolyzer industry, but it encourages energy providers to buy electrolyzers, which sends a signal to the industry that they need to figure out how to produce them in the US, and to do it cheaply.”

Alexander points to the renewable power industry in the US as a successful example, noting that incentives and other market forces encouraged innovations in producing solar panels and wind turbines more cheaply.

“The purpose of the tax credits is to help the industry get out of its infancy to a point where they can be cost competitive absent the credits,” he says. “Investment and production tax credits for utility-scale wind and solar were an important part of getting that industry to the point where it is today: It’s now not much more expensive to produce renewable power than it is to produce power from traditional, fossil-based sources.”

A gratifying practice

Infinium is only one client among many for Alexander, and his work touches on nearly every aspect of the energy sector, with projects related to renewable energy grid systems; infrastructure related to renewable natural gas, solar, hydrogen, and low-carbon petrochemicals; emissions reduction monetization; and more. Another significant deal he helped broker, the Cormorant Clean Energy Project, will involve producing ultra-low-carbon ammonia at a facility on the Texas Gulf Coast. OCI N.V. and Gulf Coast Ammonia LLC are two longstanding clients whom Alexander has assisted in the development of low-carbon ammonia production facilities. When the production of low-carbon ammonia is scaled, it has potential to significantly affect maritime transportation, power generation, agriculture, and other sectors. Another of Alexander’s clients, Monolith Materials Inc., is working to scale up methane pyrolysis technology to produce low-carbon hydrogen and carbon black, a key component in the production of tires and other products.

It all means that in the heart of US energy production, Alexander and his colleagues at Vinson & Elkins have plenty to keep them busy.

“This work requires an army of experts—environmental attorneys, tax attorneys, experts on state and local land use, and experts on foreign investment and on maritime issues. I'm fortunate to be at a place that has all the tools necessary to be able to do this type of work,” he says. “I've also been fortunate to be around very smart, driven people my entire career who have challenged me and encouraged me to do better. I'm very much a product of the institutions that I've been blessed to be part of, including the University of Michigan Law School.”