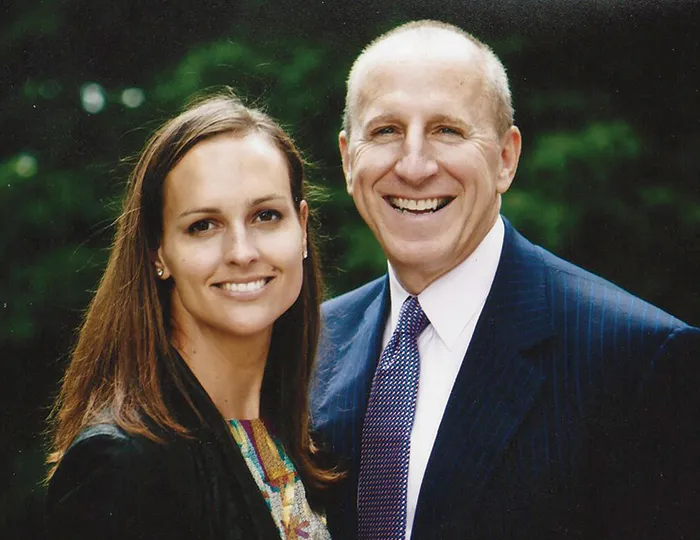

Michael Levitt, ’83, has been successful in finance largely because he follows a simple adage: Invest in what you know.

The advice also guides him as a volunteer for and donor to the University of Michigan. Levitt, who is a Los Angeles-based vice chairman of Apollo Credit Management, serves on the University’s Investment Advisory Committee and is the alumni trustee for the Law School’s Cook Trust.

Beyond the significant investment of time that these roles require, Levitt substantially invests in his alma mater as a donor, including a recent gift to the Law School’s Zell Entrepreneurship and Law (ZEAL) Program.

For Levitt, who also holds a bachelor of business administration degree from Michigan, the gift to ZEAL is important because “setting a good example for my children—that they see me work hard and give back—is a priority.” But the gift also gives a personal and professional nod to his career path.

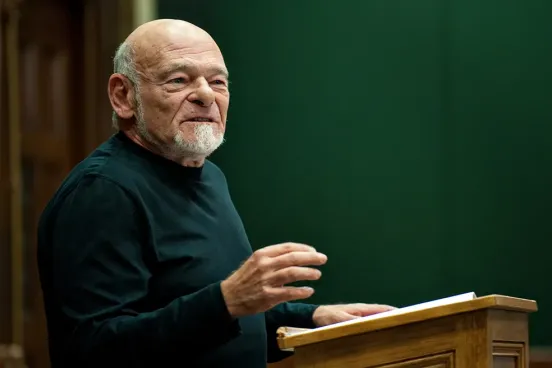

After beginning his post-law-school career at Latham and Watkins in L.A., and then opening the firm’s New York office, Levitt transitioned into finance. He was a managing director at Morgan Stanley, co-head of the investment banking division at Smith Barney, then a partner in the New York office of Hicks, Muse, Tate & Furst Inc., before deciding to open his own firm— Stone Tower Capital—in 2001. ZEAL founder Sam Zell, AB ’63, JD ’66, HLLD ’05, was the first outside investor in the company.

“I was a direct beneficiary of Sam’s belief in the importance of entrepreneurialism, so it seemed fitting for me to give a gift that supports Sam’s vision while affirming my love of the Law School and my gratitude for how it has shaped my career.”

Levitt first met Zell during Levitt’s tenure at Morgan Stanley. Their shared affinity for U-M strengthened their professional relationship, but the two savvy investors know that emotion can’t cloud business, which made Zell’s commitment to Stone Tower Capital all the more meaningful.

“Sam sensed I would be prudent with his and my money and that he would get a solid return,” says Levitt. “He derives a great deal of joy and satisfaction from helping businesses get off the ground, and I will forever be grateful that he took a chance on mine.”

Levitt grew Stone Tower during the tumultuous post-9/11 economy and established a solid reputation and portfolio that allowed the firm not only to survive but flourish in the wake of the 2008 financial crisis. Levitt says the dual mantras of “invest in what you know” and “if it’s too good to be true, it probably is” helped him stay the course as industry heavyweights toppled all around him.

“We survived because we were conservative in our assessment and management of risk.” In 2012, Levitt sold the company to Apollo Global Management LLC, where today he is responsible for building the firm’s credit investment business.

“I don’t know if I think of myself as an entrepreneur,” Levitt says, “but I’ve always enjoyed the business-building aspect of my work as much as the execution.”

Through his gift to ZEAL, Levitt will help equip students with the knowledge and experiences to successfully launch and/or advise entrepreneurial endeavors.

“I want to see more law students inspired to become entrepreneurs and build businesses, and more students have the confidence to go out and do it. Sam’s confidence in me gave me more confidence that I could be successful. I’m excited to be part of making that happen for others.”