Legacy gifts from generous alumni and friends provide the support needed to sustain the Law School’s long-term commitment to excellence. There are several ways to make a future gift—bequests, charitable gift annuities, charitable remainder trusts, or naming Michigan Law a beneficiary of your retirement account—and all ensure the Law School continues to offer a transformative experience for faculty and students alike, for generations to come.

Designating Michigan Law a beneficiary of all, or a portion, of your qualified retirement account—IRA, 401(k), or 403(b)—is an easy way to make a legacy gift.

Bequest

Susan Bart, ’85

Partner, Schiff Hardin LLP (Chicago)

“Teachers, mentors, and the schools I’ve attended have influenced me and contributed to my professional successes. I am indebted to them and grateful for the ability to repay that debt by mentoring others, contributing to the legal profession, and financially supporting my alma maters. Through my bequest to Michigan Law, I am very pleased to ‘give back’ and help the Law School recruit outstanding law professors in the future.”

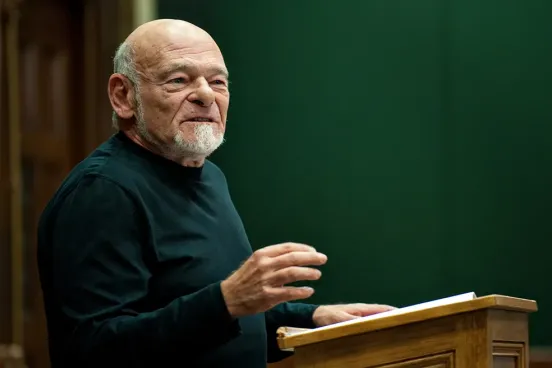

Charitable Gift Annuity

James Waters, ’70

Founder, James L. Waters Law Offices PC

(Muskegon, Michigan)

“It’s a simple process that ensures a future gift without giving away all your money. I can show my appreciation for the Law School, one of my first loves, and still have income for the rest of my life. You can’t beat that.”

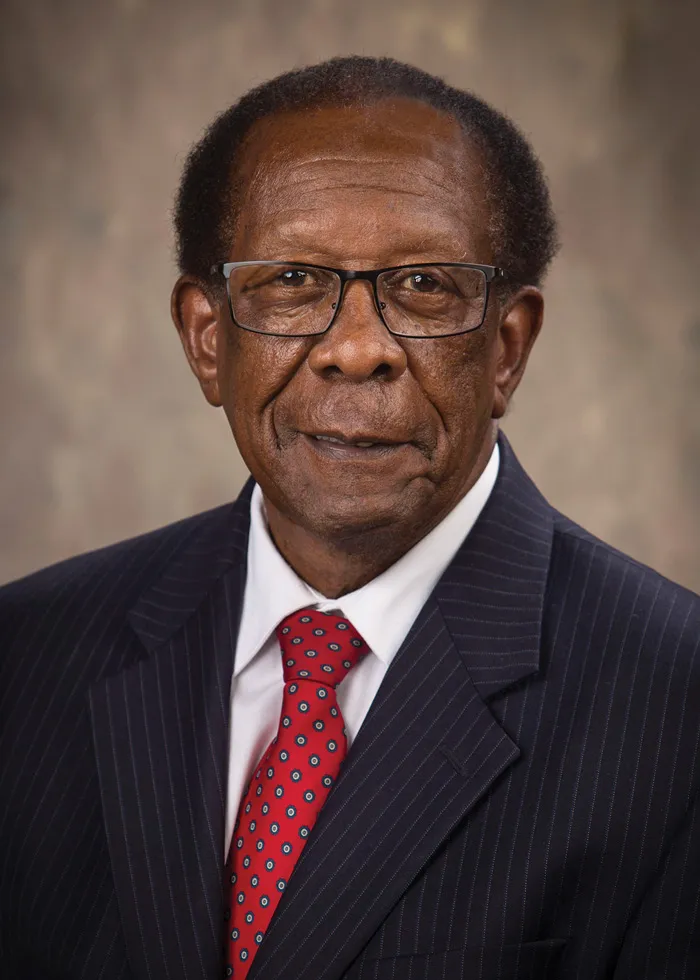

Charitable Remainder Trust

Dewey Crawford, ’66

Retired (Northbrook, Illinois)

“By using appreciated stock to establish a charitable remainder trust, I was able to give back to the Law School and provide income for my wife and me for the rest of our lives. There also were nice tax savings. I avoided paying income tax on the gain and received a charitable deduction for a portion of the gift when I established the trust. It’s great to know my gift will support two of the ‘loves of my life’—first, of course, my wife, and second, my alma mater—Michigan Law.”

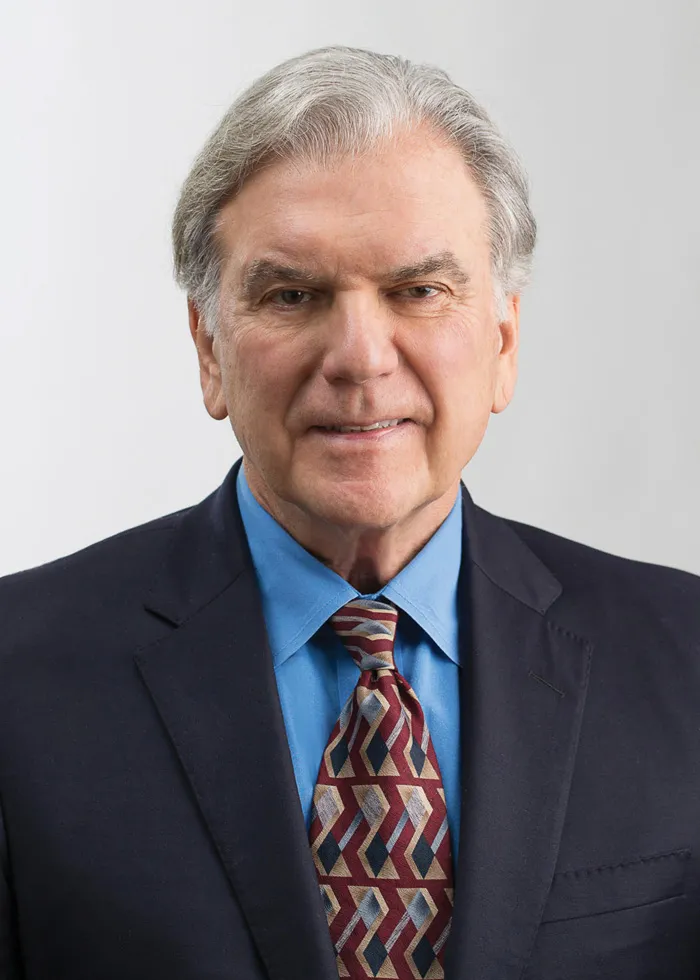

Retirement Account Beneficiary

Arnold Nemirow, ’69

Retired (Mount Pleasant, South Carolina)

“To honor my father, who immigrated to the U.S. and sacrificed so that I could have an education, I established the Benjamin Nemirow Scholarship Fund. I launched it with cash gifts a few years ago, and I’ll significantly enhance it through my estate. Naming the Law School a beneficiary of my retirement account was easy and a great way to help future Michigan Law students.”

For more information about any of these options, or if you already have included the Law School in your estate but haven’t yet informed us, contact Erica Munzel, ’83, director of leadership gifts and planned giving, at 734.763.0414 or [email protected]. We welcome the opportunity to thank you for your future gift, ensure that your gift is used for your intended purpose, and count it in the Victors for Michigan Campaign.