On the last Thursday in July, members of Michigan Law’s Low Income Taxpayer Clinic (LITC) arrived early at Legal Services of South Central Michigan in Ypsilanti to set up for their walk-in tax event.

By 9:30 a.m., a half hour before the doors opened, four people were already waiting in line. Their early arrival was an indication of the busyness that was to come.

The walk-in tax clinic assisted low-income community members with their tax-related issues at no charge. It brought together representatives from the Internal Revenue Service’s Office of Chief Counsel, Taxpayer Advocate Service, and collections personnel; United Way’s Volunteer Income Tax Assistance Program; the State of Michigan Department of Treasury; and the LITC, which was the sponsoring organization.

The LITC is the recipient of a federal grant from the IRS Taxpayer Advocate Service to provide free tax-related services to the community, including walk-in events such as the one held last summer.

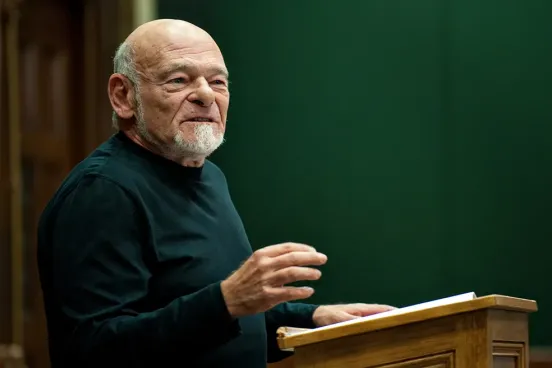

“The event was premised on the idea of getting the right people together in the same room at one time, like a traveling road show of services,” says Nicole Appleberry, ’94, LITC director. “It was conceived by Rob Heitmeyer, one of the top guys in the IRS Office of Chief Counsel in Detroit, who wanted to offer tax resolution days throughout Michigan for the low-income community.”

Multiple rooms at Legal Services of South Central Michigan were utilized for the walk-in clinic, which resembled H&R Block during tax season. Taxpayers as young as 26 and as old as 78 sought assistance; by day’s end, 52 people had been helped. Approximately a third of those individuals had ongoing issues related to multiple tax years, Appleberry notes.

Some had simple tax concerns, such as the individual who needed to file an amended tax return and wanted to know which form and instruction booklet he should use. Others had more complicated questions about money owed to either the IRS or the Michigan Department of Treasury. Some weren’t sure what their tax issue entailed and needed help figuring it out.

“Most of the people I talked to were having issues with their taxes because they were having issues somewhere else in their lives,” notes 2L Reem El-Mehalawi, who handled intake along with fellow student-attorneys and 2Ls Patrick Logan and Axelle Vivien and clinic administrator Amy Scott.

“Some people were working multiple jobs and didn’t have the time or energy to think about their taxes; some people had lost someone important to them and stopped taking care of themselves, let alone taking care of their taxes; and some people were just trying to pay off all of their other debts.”

In addition to having their tax concerns addressed, taxpayers were able to get other help as well. “We learned that one client wanted to start a business, so we referred him to the United Way’s financial coach,” Appleberry says. “There were several people like that who ended up floating around because they needed help from multiple people. They probably weren’t expecting to get all that support at a single event.”

Appleberry says she was unsure as to how many taxpayers would take advantage of the walk-in clinic, and couldn’t be more pleased with its success. “It produced such a good feeling among those involved,” she says.

Logan, the student-attorney, agrees. “The ability for all organizations to work together on issues that usually take several days to several years to resolve made for a special event.”—LA